Banner Section

E-Commerce: A Strategic Framework to Plan for Digital Sales

Points of View - Inner

E-Commerce: A Strategic Framework to Plan for Digital Sales

Within a few clicks on the Internet you can purchase: socks, travel accommodations, cars, the original “Hollywood” sign[1], and almost anything else you could ever need, want, or imagine. Purchasing things electronically (and thus the term e-commerce[2]) has changed the landscape and fortunes of industries, businesses, and consumers. A world of geographically constrained options and purchases has been replaced by a global marketplace where information, products, and options are as numerous as innovation and ingenuity can muster.

While most modern companies have some sort of digital presence (a website, online ordering system), many have not considered the full strategic value and implications of doing business online. Our E-Commerce Preparedness Framework was developed to assist organizations in framing and solving many of the key issues of doing business in a digital world. Before presenting our framework, a few important macro-level trends and findings will be discussed to reinforce the growth of e-commerce. This validation will, at a high level, demonstrate the value and importance of digital sales both domestically (the US) and abroad.

US Technology Adoption Key to E-Commerce Growth

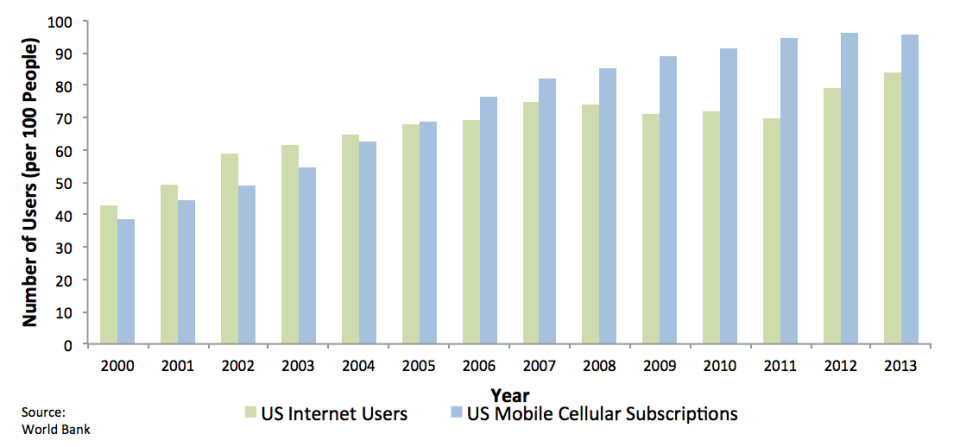

In the US, Internet usage and mobile technologies have been adopted to near complete market saturation. Figure 1 demonstrates the growth of e-commerce enabling technologies in the US (namely Internet access and mobile phone adoption). Increased access to these technologies should correlate with the growth of e-commerce and digital sales, which will be demonstrated shortly.

Figure 1 – US Technology Adoption: Internet Users and Mobile Cellular Subscriptions

Notable observations from Figure 1:

- Over 80% of the population has access to the Internet and over 90% of the population has access to mobile phones

- Starting In 2005, mobile phones have had a higher adoption rate than Internet users in the US

- Even during the recent recession from 2008 – 2012, mobile phone adoption still increased every year. (Internet usage was stagnant or decreasing before growth continued in 2012)

US E-commerce Growth Substantial

Correlating with US technology adoption, e-commerce has grown across all major sectors of US industry. Table 1 below shows e-commerce revenue data collected by the US Census Bureau in their E-Stats report released May 22, 2014. This information is organized into four sectors: manufacturing, wholesale, services, and retail.

Table 1: US E-commerce Growth by Sector

Table 1: US E-commerce Growth by Sector

Notable observations from Table 1:

- All sectors are demonstrating e-commerce growth

- Services and Retail have smaller portions of the overall sales revenues, but they are growing significantly faster than Manufacturing and Wholesale

- Even a small percentage of the overall sector (ex. 3.1% = $366M) is significant revenue

- In 2012, the largest retail merchandise category for E-commerce sales was “Clothing and Clothing Accessories (including Footwear)”with $33M in Revenues[3]

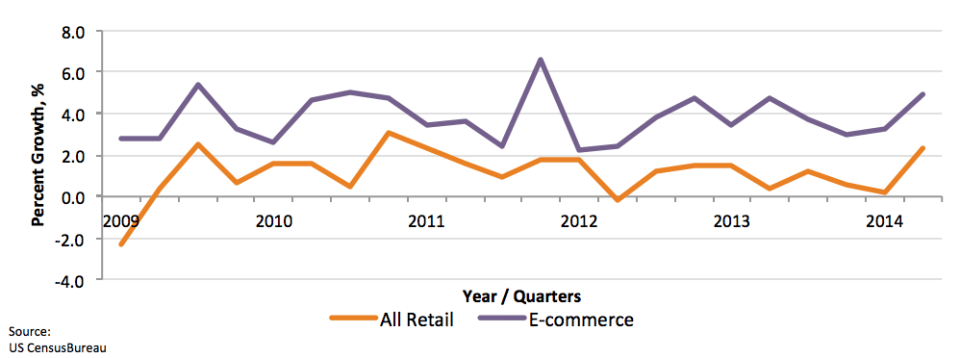

In further examination of the retail sector (arguably the sector most associated with e-commerce or digital sales), the US Census Bureau offers more current data via their Quarterly Retail E-Commerce Sales, 2nd Quarter 2014. See Figure 2 below.

Figure 2. Quarterly US Total Retail & E-commerce Percent Growth

Notable observations from Figure 2:

- Every Quarter from 2009 to 2014 has greater growth in e-commerce retail sales than all total retail sales

- Digital retail sales[4] appear to have more seasonal affects than total retail sales

- Digital retail sales are consistently growing somewhere between 3 to 5% every quarter

While a strong case for e-commerce based opportunities in the US can be demonstrated, the more intriguing and lucrative opportunities may come internationally.

Global E-Commerce Has High Potential

Online market research company, eMarketer, has performed a variety of analyses and forecasts regarding the growth of e-commerce throughout the globe. eMarketer’s findings are the result of an analysis of various elements related to e-commerce sales including: macro-level economic conditions, population figures, Internet and broadband adoption, consumer attitudes, historical trends in online sales, survey data from third parties, an estimate from other research firms, investment banks and other forecasters – at a country and regional level before building its worldwide model.[5] There is a wealth of information in these analyses some of which have been summarized or interpreted below:

- Global B2B and B2C combined ecommerce sales will top $570 billion by 2017

- E-commerce Sales topped $1 Trillion in 2012. The US accounted for $301 billion, greater than 30% of the global total. eMarketer anticipates that US growth will continue, but at a slower pace than other countries. This trend also applies to the UK, who spent $109 billion in 2012

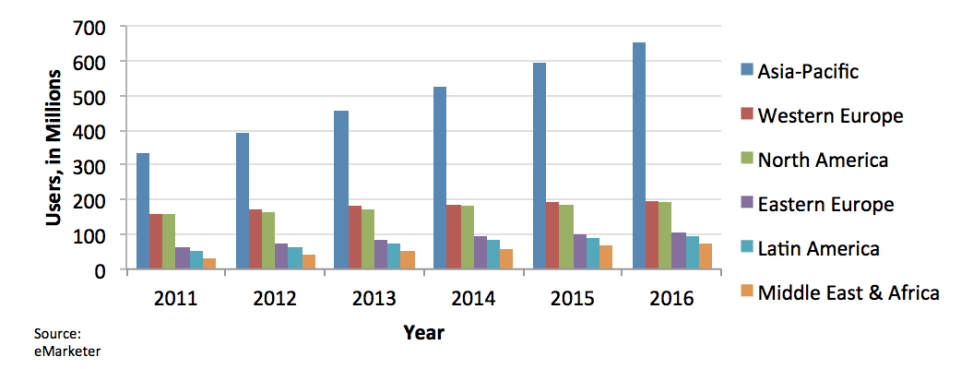

- The Asia-Pacific region will overtake the United States as the largest market for B2C[6] sales. A chief reason for this will be the rapid growth of e-commerce sales in China, India, and Indonesia. The average Chinese annual purchase is $670 (low when compared to the US annual average $2,104) in 2012, but the number of digital buyers in the Asia-Pacific region is staggering. By 2016 eMarketer believes there could be as many as 653.5 million digital buyers in the Asia-Pacific region – in comparison, less than 400 million combined digital buyers are expected in North America (197.3M) and Western Europe (192.6M). See Figure 3 below.

Figure 3: Estimated Digital Buyers by Region

To paint a complete picture of the causation, correlation, and growth of e-commerce would in itself warrant a significantly longer – and more detailed – discussion than what is currently planned. The point to be emphasized is that e-commerce growth has high potential across several major geographies with exceptional growth expected in developing countries.

With the significance of e-commerce and digital sales established, how prepared is your organization to manage this potential? Do you have the right strategy, if a strategy at all? Could this require a change organizational structure? Do you have the proper resources identified and in place? What will your competition do? These are some of the questions that need to be answered and addressed by utilizing our E-commerce Preparedness Framework.

E-commerce Preparedness Framework and Work Flow

Choosing or using a framework for strategic purposes can be a difficult and confusing process to initiate. Abstract graphics and descriptions may seem clear and logical, but mapping and matching these descriptions to real-world scenarios can be daunting. The steps needed to “plan” for e-commerce across an entire organization could be overwhelming to consider. Aligning with a framework (and corresponding workflow) will allow for the necessary resources to gather, organize, and rationalize thoughts that will ultimately drive a holistic strategic position. Attempting to do an analysis of this scale without a methodical approach has much higher potential for inaccurate or ineffective findings.

As a rule, it is helpful to consider the process of gathering information and data needed to apply a framework as more valuable than the finished framework itself. With this in mind, the E-Commerce Preparedness Framework will be introduced followed by a prospective workflow that identifies key data, activities, and deliverables needed to complete the framework

E-commerce Preparedness Framework

Our E-commerce Preparedness Framework is designed to engage strategic thinking across all key stakeholders. Five areas of importance have been identified, but in no means is this list complete or exhaustive. Customization will almost certainly be needed and is highly recommended. This framework should be viewed as a tool for preliminary discussions focused on the value and strategic importance of digital sales to your organization. The five areas of importance are:

- Organizational Structure. Any and all organizational issues/requirement that digital sales may change or affect.

- IT Requirements. Ensuring that your current IT structure is prepared for future digital sales through any necessary hardware, software, service, or talent acquisitions/development.

- Strategic Sales/Marketing. A look at how the integration of digital sales affects business development, sales operations, and marketing strategy.

- Supply Chain. Any issues that your current supply chain may have in producing digital orders (i.e. batch vs. individual orders, delivery complications, etc.

- Retail Space / Real Estate. Identifying and discussing the impact and value of the built environment (owned/leased/etc.) when considering digital sales.

Table 2. E-Commerce Framework

Table 2. E-Commerce Framework

Organizational Structure

Organizations routinely go through structural and functional realignments. An increased emphasis on digital sales has the potential to require a more defined and robust structure that includes alignment across the organization.

Consider a multi-national company that has sold primarily to retailers during the entirety of its existence. After experimenting with digital sales they have found that certain product lines may have better performance if sold directly to the consumer. Who in the organization will manage this new line of work? Should the company create a completely new organizational chain or modify existing responsibilities? Determining what new/modified roles are necessary could be instrumental in meeting strategic goals while minimizing risk.

- Is the current business structure amicable to digital sales? Will digital sales force you organization to do something drastically different than “business as usual”? Is the quality of work going to be at risk if organizational shifts or additional responsibilities are forced on the current structure?

- Are the resources in place with the necessary skills to implement a digital solution? Expertise must be in place to gather necessary information about products, sales, deliveries, and customer satisfaction. Can these resources be shared in their current roles or do they need to be dedicated? What metrics will be used to measure their efficiency? Is outsourcing a potential solution?

- Who are the internal / external key players and are those relationships sufficient? It is imperative that all key players understand their roles and responsibilities. Supply chains and transportation relationships become increasingly important when selling directly to a consumer. New strategic relationships may need to be sought in order to leverage the best skill sets. Can old partnerships still deliver the needed services as business requirements change?

Risks of Being Unprepared: Without proper organizational infrastructure in place, minor issues could become serious and significant issues could become disastrous. An increased importance on digital sales could blur the line between business and IT functionalities; failure to organize and manage properly leaves your organization in a weak position with no real chance to mitigate losses.

IT Requirements

Information Technology (IT) has become so important to doing everyday business that it is a key (if not core) component of every department within an organization. Identifying, selecting, designing, implementing, and improving technologies is on-going and often essential to meeting strategic goals. To strategically align IT requirements with a growth in digital sales, core services and functionalities need to be managed and improved as necessary. These services and functionalities include: online sales portals (mobile and desktop), order tracking and validation, data collection, data storage, and others.

Imagine a small local shop that makes and sells natural beauty products. After having success in their retail store they decide to offer their product online. After a month of positive sales they quickly realize that it will be difficult to produce, ship, and track these products while managing growth. What needs to be done in order to solidify their technology requirements to continue growth? How will they scale and plan for the future?

- What key metrics help to run the business and can they be tracked? One of the most beneficial aspects of selling products online is the ability to collect data to improve the experience for your consumer in hopes to encourage future sales. What information do you need to track and gather for the business? How can this information be used to drive future strategic decision? Is there additional information that would be good to have in the future?

- What is your organizations’ ability to manage IT needs in-house vs out-sourcing? An organization can have an IT department of various sizes and sophistication. Having a firm grasp of what your resources can/can’t do in relation to your strategic needs is key to getting the best value for your investment. Do you have the necessary infrastructure and skill set to operate digital sales internally or would they be best served by a 3rd party? How much could/should you develop internally?

- How/Where is the best way for you to sell your products/services online? There are advantages and disadvantages to having a private online portal vs selling from a larger online retailer, like Amazon. A private store will allow you to control the display and experience of your products, but will ultimately require a greater investment. Selling elsewhere might be less expensive, but it might not provide the data that you want in order to make future decisions. Does where you sell a product matter to your strategy? Can you get the data you need from a 3rd party vendor?

Risks of Being Unprepared: A less than adequate IT structure could leave your business unable to take, deliver, or fulfill digital orders. All systems need to be capable of handling current and future capacities (both average and seasonal loads – which could be extremely critical to your organization). Failure to manage properly could erode brand value and weaken consumer confidence.

Strategic Marketing/Sales[7]

A product’s digital and physical existence need to align to reinforce its chosen values and benefits. Effort and planning must be taken to ensure that a consistent and effective message helps drive a unified customer experience that will ultimately result in sales. By focusing on a unified experience, there is potential for more robust data collection that can strengthen the marketing and sales functions of an organization. In todays’ marketplace, store hours and locations don’t necessarily matter – only the real and perceived unique value that your product can provide.

If an airline uses a website for a majority of their travel bookings (as nearly all do now), what is the experience like for the consumer? Is the process seamless or at the very least not frustrating? Rewards programs and customer profiling can be used to provide additional value and information for future flights and/or special events at the destination. Any real or perceived value that can be offered to a customer is important before, during, and after the flight has occurred.

- Do you have an evolving or stagnant growth plan in place? Is your digital store viewed as an integral part of your sales platform or simply a “box to check”? If digital sales are not an integral part of your sales strategy there needs to be sound reasoning behind it. Otherwise, an active approach to grow and understand the nature of your digital customers’ preferences needs to be a priority.

- Are new technologies being leveraged effectively? Technology is evolving constantly, particularly mobile technologies, and there can be significant opportunities if leveraged properly. Enriched customer profiles, location-based sales, social networking, and a slew of other innovations can be implemented to help drive and sustain sales. Have these ideas (and others) been explored? Are there viable opportunities in your business/industry?

- Are your sales strategies aligned? How are most of your sales performed? In person? On-line? Is there any strategic crossover between the two? Developing a holistic sales strategy can strengthen the overall message you want to consumers while creating a seamless and effective sales operation procedure.

Risks of Being Unprepared: If your current strategy fails to use digital techniques properly (SEO, Social Media) or lacks a creative value proposition to the consumer, the overall perception of your brand could dip followed shortly by sales. In a world where a poorly worded tweet can put you into the national news cycle, having a formulated plan and strategy is an imperative.

Supply Chain

Digital sales can easily disrupt the supply chain and manufacturing processes. Increased digital sales, while increasing revenue, can potentially expose flaws and chokepoints of the supply chain. Supply Chain cannot be an afterthought of the strategic process; it needs to be a priority.

Consider a company that has begun to explore direct customizable sales to customers. These orders are unique and need to be tracked separate from the large batch orders that are traditionally produced. The managerial and organizational requirements to allow both production processes work seamlessly could be challenging to say the least. How will this change be managed, tracked, and accounted for across the organization?

- Does your manufacturing process allow for the segregation of batch and individual orders? Does the size/type of an order have adverse effects on the manufacturing process? Can batches and individual orders be easily produced, delivered, and accounted for? Can the marginal costs of an online order be measured and compared to a batch order?

- Would an increase in digital sales adversely affect your production processes (including delivery)? If digital business increases, could your current processes handle the variances? If digital sales are expected to increase it stands to reason that the processes for making and delivering these products must be robust and efficient.

- Are there any organizational roadblocks that further complicate the supply chain’s ability to be flexible? Other business functions (such as finance) may have significant requirements and access points across the supply chain. Managing necessary tax and legal documents could also cause unintended consequences. Can you actively map the internal/external forces acting upon the supply chain that don’t actually involve producing products?

Risks of Being Unprepared: A healthy supply chain is one that is constantly evolving and improving, not stagnant and fixed. Significant increase in digital sales could change many of the key decisions used in your supply chain (individual vs batch production, build vs buy, store vs. ship, etc.). Failure to consider the importance e-commerce and digital sales has on your supply chain could lead to inefficient costs, poor capital investments, and a less competitive product.

Retail Space / Real Estate

As digital sales increase, the purpose and function of retail locations could change. Engaging customers in new and exciting (and most importantly effective) ways will be the key to making the investment of a physical property an acceptable expenditure.

Envision a furniture store that does more than offer product dimensions on line. It provides a tool to enter dimensions of rooms and selected furniture which is then rendered into a 3D interactive graphic. To take it one step further, customers may come into the store to see a real life version of the room with mock walls and decorated spaces. This provides the customer with a unique perspective before purchase while also allowing the store to a better chance to sell products and additional services.

- Do most of your customers want to see a physical product before purchase? Why? Online sales are all about convenience. If your product can be sold without a physical presence required a substantial amount of indirect costs can be saved. If customers need a physical presence, how can the experience be improved or enriched?

- Do traditional retail options best serve you strategic plans? If digital sales become an increasingly large portion of your sales, it may be necessary to consider the value and type of physical presence employed. Have smaller or temporary (pop-ups) been considered?

- Can you leverage your physical locations with you digital infrastructure? Combining your digital and physical presences offers the possibility of unique value propositions. Is there a way that value can be presented to a customer that blurs the line between digital and physical sales?

Risks of Being Unprepared: Capital investments like retail shops need to be utilized in ways that maximize revenue generated per square foot. New trends in digital sales could be leveraged to provide a unique and valuable customer experience, failure to recognize this potential puts you at risk of investing too heavily in assets that may not perform as anticipated and/or not being able to adapt to completion.

E-commerce Preparedness Framework Workflow

In order to realize the value of the E-commerce Preparedness Framework a significant amount of planning and work would need to be undertaken. In hopes to expedite these processes the following workflow has been developed. Depending on the capabilities of the organization, this could be done internally, externally, or by a combination of the two. However, there are three major imperatives of utilizing the framework and the workflow: (1) Digital sales must be found to be an important aspect of the organization, (2) there is significant buy-in and support at the executive and business function(s) level and (3) the ability to track digital vs. non-digital sales is existent.

A typical workflow used to implement the E-commerce Preparedness framework would use five phases: Initiate, Discover, Analyze, Identify, and Strategize. Alternations and substitutions could be made as needed, but for the sake of clarity and to provide an actionable example, these five will be taken as suitable. More detailed information can be seen on the following page.

- Initiate. This phase begins with the objective to align business functions and develop goals for the assessment. Initial discussion surrounding the framework must be answered and hypotheses for e-commerce’s affects to the organization will be developed. Resources will be identified and a plan for developing the remainder of the E-commerce Prepared Framework will be created and approved by all parties.

- Discover. Information and data must be gathered and verified in relation to internal and external factors. This data could include: sales reports, production costs, shipping costs, competitive data, IT metrics, etc. This phase of work will not only provide the team with the data it needs to implement the framework, but will also identify gaps in the current model where information needs to be refined. This phase will more than likely be iterative in conjunction with the Analyze phase

- Analyze. Various analyses will be performed in this phase that will support or reject initial hypotheses. A variety of other frameworks could be implemented to enhance the knowledge base of the organization (Porter’s Five Forces, SWAT, etc.). Financial models will likely be built to model and test the value of investments in technologies, external services, etc. This phase will more than likely be iterative in conjunction with the Gather phase

- Identify. Each area of importance will be matched against the E-commerce Framework. Discussions will take place with the team to determine the best way to proceed and initial goals or corrective actions will be planned as needed.

- Strategize. The prescribed changes to the organization will begin to be formulated and prioritized. A review of the overall process will be done in order to verify the value of the E-commerce Preparedness Framework and to ensure that lessons learned will be applied to future processes and analyses

Figure 4. E-Commerce Preparedness Framework Workflow

Figure 4. E-Commerce Preparedness Framework Workflow

E-Commerce Preparedness Key Deliverables

- Team Charter. Establishes goals, timelines, team members, resources, completion criteria, and any other metrics needed to ensure that the framework assessment is successful.

- Roles & Responsibilities. Defines and confirms the expectations for engagement and time commitment for all team members.

- E-commerce Hypothesis – Digital Sales. A preliminary assessment of the E-Preparedness Framework that provides a “semi-educated” guess as to where the organization will be ranking at the end of the assessment.

- Framework Plan & Schedule. Detailed work plan and schedule for the completion of the E-commerce Preparedness Framework that includes milestones and task responsibility.

- Proposed Organizational Structure. A proposed organizational structure focused on ensuring that digital growth is both well represented and can be effectively managed. This deliverable will likely be in the form of a traditional org chart graphic with any detail necessary provided.

- Guideline for IT Improvements. Recommended areas of improvement for IT in regards to digital sales. A list of recommendations with corresponding support provided to (1) close any current gaps that might exist within the IT available to the organization and (2) maximize the value of IT in preparation for any evolving digital sales strategy.

- Digital Strategic Marketing Suggestions. Recommended strategic marketing initiatives to best incorporate a holistic digital sales strategy. Includes recommendations for digital portal, social media, and crossover (digital/physical) promotions.

- Key Risks for Supply Chain. Major areas of risk for the Supply Chain as it relates to an increase of digital sales. Can include supplier, manufacturing, and shipping processes.

- Real Estate Risks. A list of potential strategies for utilizing real estate and other capital investments to cater to increased digital sales. Suggestions will be more strategic than financial, and will look to toe into any strategic marketing suggestions.

- Gap Analysis – Digital Sales. A detailed view of the capabilities currently offered vs. those needed for digital sales success.

- E-commerce Preparedness Position Paper. Document that summarizes the teams’ overall findings and provides supporting documentation for each area on the E-commerce Preparedness framework.

- Placement on EP Framework. Finalized E-commerce Preparedness Framework based off of position papers.

- Proposals for Strategic Improvements. A list of improvements that can be made for each area of importance that aims to improve its current status. Proposals should be realistic given organization time, cost, and resource constraints.

- E-Commerce Preparedness Report. Finalized Report containing prior deliverables (as needed) and drawing lessons from the frameworks itself and the process used to complete the framework. Actionable suggestions provided for improving digital sales preparedness.

Conclusion

Technology, and in effect e-commerce, are changing the way that modern businesses compete and perform. In order to maximize effective strategies, tactics, and plans, serious considerations need to be taken to conform to this ever-changing environment. While every situation is unique, digital sales could seriously disrupt a business in a variety of ways without proper strategic planning. Major areas of importance including: Organizational Structure, IT Requirements, Strategic Marketing, Supply Chain, Product/Portfolio Management, Retail Space / Real Estate, and etc. should be considered by using the E-Commerce Preparedness Framework. Doing so (and modifying as needed) will create a clearer picture for your organization and allow the development of appropriate goals and strategies.

About the Author

Bryce Ritter is a Consultant with Kenny & Company. He leads and supports the defining, analysis, planning, implementation and overall execution of client engagements. Bryce has a BS in Civil & Environmental Engineering from Virginia Tech and a MBA from the College of William & Mary.

About Kenny & Company

Kenny & Company is a management consulting firm offering Strategy, Operations and Technology services to our clients.

We exist because we love to do the work. After management consulting for 20+ years at some of the largest consulting companies globally, our partners realized that when it comes to consulting, bigger doesn’t always mean better. Instead, we’ve created a place where our ideas and opinions are grounded in experience, analysis and facts, leading to real problem solving and real solutions – a truly collaborative experience with our clients making their business our business.

We focus on getting the work done and prefer to let our work speak for itself. When we do speak, we don’t talk about ourselves, but rather about what we do for our clients. We’re proud of the strong character our entire team brings, the high intensity in which we thrive, and above all, doing great work.

Notes

- Unexpectedly true. See http://www.ebay.com/gds/TOP-5-STRANGEST-THINGS-EVER-SOLD-ON-EBAY-/10000000011731589/g.html.

- From the US Census, E-Commerce describes transactions sold on-line whether over open networks such as the Internet or proprietary networks running systems such as Electronic Data Interchange (EDI).

- See US Census Bureau in their E-Stats report released May 22, 2014.

- Digital Retail sales and e-commerce sales/revenue may be interchanged throughout.

- See eMarketer as referenced.

- “Business-to-consumer”

- Strategic Marketing/Sales can be a reasonably confusing or ambiguous term in business. For this discussion “Strategic Marketing/Sales” refers to any strategic plans or initiatives and any corresponding tactics used to bring a product(s) to market and sell it to a consumer. This includes any research, analysis, and sales strategies that were utilized throughout the process of developing a strategy.

References

- “25 Ways We Saw the World Change” 2013 Annual Report. Goldman Sachs. (2014). Web. October 2014.

- Colao, J.J. “The Future of Shopping in Three Trends.” Forbes, 2014. (August 4, 2014). Web. October 2014

- “E-Stats” U.S. Census Bureau. US Department of Commerce, Economic and Statistics Administration. (June 12, 2014). : 1-6. Web. October 2014

- “Ecommerce Sales Topped $1 Trillion for First Time in 2012.” eMarketer. eMarketer Inc., 2014. (Feb. 5, 2013). Web. October 2014

- Elsingerich, Andreas B and Tobias Kretschmer. “In E-Commerce, More is More.” Harvard Business Review. (2014) : 1-3. Print

- Hemp, Paul. “Are You Ready for E-tailing 2.0?” Harvard Business Review. (2006). Web. October 2014

- “Internet Users (per 100 people).” The World Bank. The World Bank Group, 2014. Web. October 2014

- “Mobile Cellular Subscriptions (per 100 people).” The World Bank. The World Bank Group, 2014. Web. October 2014

- Rigby, Darrell K. “Digital-Physical Mashups.” Harvard Business Review. (2014) : 1-10. Print.

- …. “The Future of Shopping.” Harvard Business Review. (December 2011) : 1-12. Print.

- “US Retail Trade Sales – Total and E-Commerce.” Monthly & Annual Retail Trade. U.S. Census Bureau. (May 22, 2014). : 1-6. Web. October 2014

- “Quarterly Retail E-Commerce Sales, 2nd Quarter 2014.” U.S. Census Bureau. (August 15, 2014). : 2-3. Web. November 2014

This article was first published on www.michaelskenny.com on January 14, 2015. The views and opinions expressed in this article are provided by Kenny & Company to provide general business information on a particular topic and do not constitute professional advice with respect to your business.