Banner Section

Establishing Optimized Portfolio Management

Points of View - Inner

Establishing Optimized Portfolio Management

Portfolio Management is a sought after capability for most organizations as they take on an increasing number of ideas to be converted into projects or programs. It becomes the way for cost center owners to maximize capability generation, and streamline investment for the budget apportioned to them by the executive leadership team within an organization. Portfolio management involves both selection of incoming ideas and the continuous assessment of existing projects and programs. Standing up a portfolio management function is complex and the correct level of investment control needs to be matched with the organizations size and complexity of initiative pipeline. However in most cases, light weight tools are best and promote an agile and responsive environment. Too often portfolio management becomes synonymous with large IT system rollouts to track and monitor pipelines, general ledger activity, and project plans in difficult to maintain formats. The overhead of operating these roll-outs and systems gets in the way and disrupts the inherent nature of idea generation, further pointing to the need for lightweight portfolio management tools.

This paper focuses on helping to define the correct level of portfolio controls for an organization weighed against its size and other factors. It also identifies the minimum data required for tracking at each level. It builds upon the concepts in a previous Kenny & Company paper, “Setting the Foundation for Strategic Portfolio Planning” which focused on efficient methods for capturing and defining ideas to the point a decision making body is able to correctly assess value.

Portfolio management takes on the same purpose regardless of where it is implemented – to maximize return on investment for current and future assets. Within this paper the assets are project, programs, and ideas which serve as capability development mechanisms for an organization. But like any investment, standing up a portfolio management function is itself a project and is thus subject to the law of diminishing marginal returns. Smaller and less complex organizations can therefore get away with less investment in portfolio management to get maximum return. When a portfolio management function is operating as needed it should provide the following benefits to an organization:

- Minimum investment of funds needed for the planning range of the portfolio

- Expected staffing requirements for the planning range of the portfolio

- Estimation of value or capability delivered by idea/effort

- Basic demographics and grouping by theme of project, programs, and ideas

- High-level summary of realized cost incurred, staffing used, and value gained in past periods

For each of the above bullets the quality of information coming from each will roughly depend on the maturity level of the portfolio management process and control mechanisms put in place. Portfolio maturity is described at the following levels:

- Level 0: Ad hoc / Minimal – No formal reason for selection of projects from idea pool, possible minor project tracking on inflight projects/programs.

- Level 1: Fire and Forget – Rudimentary non-structured ideas are presented on a planning cycle and added to the queue for the next planning cycle based on budget. Somewhat formal tracking of inflight projects exists, possibly by a PMO. Once selected, the idea probably always executes and stays in flight as a project unless it becomes noticeably unhealthy and garners attention requiring action. Many organizations exist at this level.

- Level 2: Basic Multi-Year Planning – Basic idea structuring is in place (perhaps similar to the Lean business concept of an A3 / One Page Overview), and these are formally reviewed to coordinate a multiyear plan. Ideas are tracked somewhat formally in a list each year. There may be some reviews of major milestones on large active investments, but this most likely does not adjust the portfolio composition except in hi-profile situations that occur.

- Level 3: Structured Idea Tracking – A structured tracking method is put in place maintaining all pertinent key details from an Idea Package[1](value, cost, resources, etc.). Teams are trained on how to generate idea packages. Ideas are kept up to date, however, there is no formal feedback mechanism to the portfolio management function for active investments. There does exist however more formal tracking of milestones across most active investments potentially via a PMO or other governance body.

- Level 4: Active Investment Tracking and Control – Commitments to external portfolio groups are tracked. A feedback mechanism exists allowing staffing and funding adjustments either from revised return expectations or funding needs of active investments. In addition, a responsive business function exists highlighting emergent changes to strategy. Based on these, defined rules allow for reprioritization to the portfolio composition.

- Level 5: Return Tracking and Continuous Improvement – Provides tracking of return over expected return period for completed projects by theme, along with stronger quantitative risk / effort factors. Future investments incorporate this feedback into more formal risk investment model applying a Risk Adjusted Discounting on each idea in the backlog.

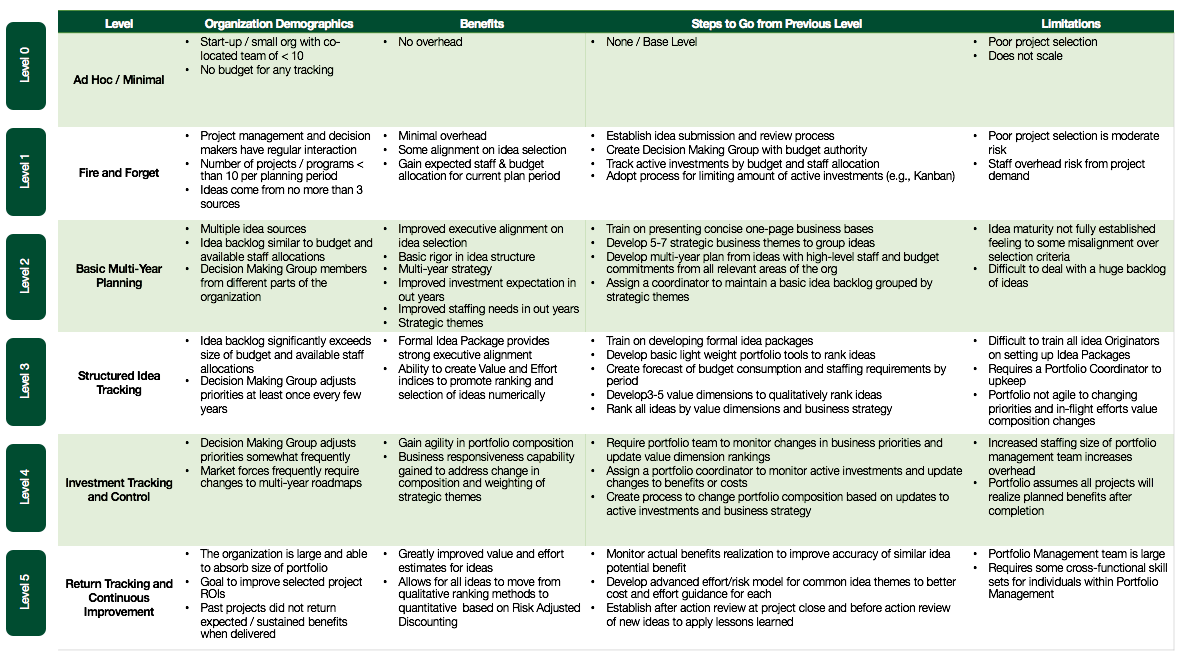

The following summarizes each level of portfolio management.

Table 1 – Levels of Portfolio Management

The Baseline, Level 0 – Ad Hoc

An organization that works best at Level 0 probably a startup or less than 10 individuals that are mostly located in the same physical location. At this size all members of the organization are more than likely aware of each other’s daily activities and all are able to organically realize and agree on 1-2 ideas which are concurrently shared among most members of the group.

When a team is this small, there is no real return for any tracking other than the most basic methods (e.g. perhaps a whiteboard, sticky notes, or some other rudimentary mechanism to track small scale efforts). It is only when the team finds they begin to grow just a bit that they need to consider moving to Level 1 Portfolio Management, enacting some basic process and control mechanisms to select ideas.

Setting up Level 1 – Fire and Forget

An organization that works best at Level 1 probably is small enough such that the Decision Making Group responsible for idea selection has significant and regular interaction with the Project Management Group running various active investments. The size of the portfolio is probably no more than 10 efforts at any time and the idea channels are limited with idea contributors all also having regular interaction with the Decision Making Group.

When organizations are small enough to achieve regular organic conversations on a day to day basis about new ideas, and active investments all of the stakeholders can interact with one another. This results in diminished return for adding additional process around idea selection. As the organization grows in size, it will begin to need additional process around portfolio management and idea management. If poor project selection, alignment issues with idea selection, or frequent staffing overloads occur, it is probably a sign that the organization is outgrowing the minimal nature of Level 1. Steps needed to implement the Level:

- The organization should stand up a Decision Making Group for any individual that owns a cost center(s) within the portfolio.

- To ensure the decision making group is selecting ideas effectively, the organization should develop a basic idea submission process which at least creates an action for the decision makers to approve or deny the idea.

- A process should be created with appropriate artifacts (most likely excel or an electronic list) to track active investments by their planned budget and staff allocations.

- The organization should place some methodology in place that limits Work in Process to avoid too many concurrent efforts occurring and draining staffing resources. Adopting something similar to Kanban, or simply assigning high level estimation point and limiting the amount of points is an excellent low cost starting point to limit Work in Process.

Moving to Level 2 – Basic Multi-Year Planning

As an organization gets somewhat bigger they begin to have members of their Decision Making Group responsible for idea selection no longer co-located. Also it is typical to find that ideas come from multiple sources and are great enough in number to supply projects for a few years. When this scale is reached it is time for an organization to begin operating at Level 2. Level 2 focuses on creating a picture or multi-year roadmap that provides an overarching strategy at a long enough timeframe that the Project Management Group understands enough about the business objectives to not require day to day conversations with the Decision Making Group.

As the size and complexity of a Level 2 organization’s Idea Backlog grows they will need to consider the additional structure proposed at Level 3. At Level 2 the amount of ideas should not be too far in excess of what is able to be accomplished in one multi-year roadmap, meaning significant time is not required to constantly kick out low value ideas. Steps needed to implement the level:

- Complete all items from the preceding level first if not done already.

- In order to make better use of the Decision Making Group’s time it is important to train all idea originators on presenting concise one-page business cases. The lean A3 concept[2] is an excellent template for providing one-page business cases for ideas and requires limited training investment.

- As the organization is not in constant contact anymore it is very important for the Executive Leadership Team to develop 5-7 strategic business themes to group ideas. These strategic themes allow Idea Originators to know which areas are likely to have ideas that will be perceived as valuable. It also focuses the organization around each theme.

- The portfolio team should assign someone (perhaps a coordinator role) to maintain a basic idea backlog grouped by strategic themes. This Portfolio Coordinator keeps track of the ideas and works with Idea Originators to scrub and clean one page overviews of each.

- Every 2-3 years the organization should come together to develop a multi-year plan from ideas with high-level staff and budget commitments from all relevant areas of the organization. This will ensure that even though not all members of the organization are co-located and talk on a daily basis, that they all have a plan and agreement to work towards.

Moving to Level 3 – Structured Idea Tracking

As an organization gets more mature with developing ideas for its backlog it begins to run into issues with alignment over the selection of ideas in each multi-year period. This frequently occurs as market conditions fluctuate leading to new thoughts on how to respond. Also in conjunction with this, the Executive Leadership Team of an organization probably adjusts the overall strategic themes a few times each multi-year period in response to market forces. The increased volume of Ideas and variety is the focus of Level 3. Level 3 Portfolio Management seeks to provide more process and tracking around ideas to make it easier for the Decision Making Group responsible for idea selection to coordinate on a plan consistent that creates the most value via new capabilities within the organization.

In addition to more process, a Level 3 Portfolio typically requires a dedicated staff member known as a Portfolio Coordinator to catalog and upkeep the ideas in a more formal manor. As the organization’s investment in new capability generation increases, and as the environment they operate in becomes more dynamic they need to move past Level 3 to become more agile to market forces and reduce investment loss from redefinition of valuable capability occurring multiple times in a single planning period. Steps needed to implement the level:

- Complete all items from the preceding levels first if not done already.

- Work with the Executive Leadership Team of the organization to develop 3-5 value dimensions to qualitatively rank ideas. These items should then be agreed to in order of importance and ranked on their value to the Executive Leadership Team on a consistent scale (such as 1-10, highest number a most value). Doing this will enable the Portfolio Management Team to quantitatively value each idea in conjunction with the other steps below for Level 3.

- To enable structured tracking more rigor must also go into the ideation process. To enable this, all Idea Originators should be trained on developing formal Idea Packages. Part of the Idea Package involves scoring each value dimension noted above for each idea.[3]

- Using the list of ideas of active investments the Portfolio team must also develop basic light weight portfolio tools to rank ideas and active investments. A simple tool such as an Excel workbook will suffice. To complete this the Portfolio Team must use something similar to a Decision Matrix[4] to create a Net Value Score of each idea and active investment. To make the quantitative Net Value Score of each item in the portfolio more meaningful it is often good to normalize the raw value to become a Value Index (typically with a range of 1-10 makes for easy review by most stakeholders).

- Part of the Idea Package also involves quantifying high-level estimates for staffing, cost, and duration. To make effective tradeoff and ranking analysis it is recommended to develop another Index for Cost-Effort using a Composite Score Methodology[5] . The top Level of the Effort-Cost Index should roughly correspond with the same 1-10 range as the Value Index to ensure easy comparison. Where 1 would be little effort and 10 would be significant effort.

- Using the Value Index and the Effort-Cost Index each item in the portfolio should be grouped into 4 areas (Typically High Cost-Low Value, Low Cost-Low Value, High Cost-High Value, and Low Cost-High Value). With this each group can be prioritized quickly.

- Using the duration, cost, and staffing of each item in the portfolio, a straight line forecast can be applied to give rough guidance on budget consumption and staffing needs by period. This forecast may further refine idea selection when performing multi-year road mapping initiatives.

- The Portfolio Coordinator role (if not already started) must now be increased to include facilitating completion and accurate capture of the data within each Idea Package delivered to the Portfolio. The Portfolio Coordinator should also begin setting up regular review sessions of completed Idea Packages with the Decision Making Group responsible for idea selection.

Moving to Level 4 – Investment Tracking and Control

As an organization’s portfolio of active investments increases in size it runs into the issue that changes in strategy to address market forces leaves some active investments in a potential diminished value state. Also with these increased changes coupled with growth in capability investment, an increasing number of active investments will run into issues that change either their benefits or cost/effort expectations. When issues arise from a large portfolio of active investments described above it is time to move a Portfolio to Level 4. Level 4 Portfolio Management focuses on providing the organization with agility to quickly recomposing the make-up of active investments. It increases the requirement on the Portfolio Coordinator to upkeep details of active investments which are relevant to value and effort, and it also adds more responsibilities to the Portfolio Management team for tracking needs of the marketplace and in deciphering updates to strategy delivered by the Executive Leadership Team.

These increased responsibilities may require addition staffing to the portfolio to support the increased overhead associated with it. Due to the size of a Level 4 Portfolio, the increased overhead is offset by savings from discontinuing obsoleted, diminished value, or adjusted value investments from changes. If the organization’s portfolio of active investments continues to grow in size it will eventually require a continuous improvement approach specified in Level 5. Steps needed to implement the level:

- Complete all items from the preceding levels first if not done already.

- In order to be responsive to the needs of the business the portfolio team must begin to monitor changes in business priorities from around the organization and have these confirmed with the Executive Leadership Team. If priorities change the portfolio team must work to quantify updates to value dimension rankings, and then analyze any changes to the items groupings within the portfolio from updates to the Value Index of each item.

- The Portfolio Coordinator must begin to monitor active investments. This will typically be done by gathering information from a PMO or some other group the organization uses to assess the health of each project and program. If any of the active investments begin to have changes to benefits or costs the Coordinator must reflect this within the Portfolio Tracking Tool. If any of the changes are significant they should be raised to the Decision Making Group to see if the active investment should be suspended in favor of other ideas in the backlog.

Moving to Level 5 – Return Tracking and Continuous Improvement

As an organization grows very large along with its portfolio of active investments, it makes sense to focus on additional continuous improvement efforts. Even strong Level 4 Portfolios will see some active investments fail to realize expected benefits at the level proposed when it was an idea. When an organization can see a positive return on investment for proactively adjusting or improving both its idea backlog, and active investments it is probably ready for Level 5.

Level 5 focuses on creating continuous improvement mechanisms to both increase the accuracy of value and effort measures in ideas, and to provide guidance to new active investments on past lessons learned. Over time, increased accuracy of idea value and effort may allow the portfolio to use very complex algorithms for cost and effort to translate all ideas in terms of Net Present Value using a Risk Adjusted Discount Rate model[6] . Doing so almost eliminates the Decision Making Group’s role for idea selection as the most logical choices are the ones with the highest NPV operating within budget and staffing constraints. Steps needed to implement the level:

- The Portfolio Coordinator should work with each area of the business where completed projects occurred to monitor actual benefits realization. Using this they should work with analysts within the Portfolio Team to provide guidance to Idea Originators for improving accuracy of similar ideas with potential benefits.

- The portfolio team should develop a core analyst group that focuses on developing advanced effort/risk models for common idea themes to better guide cost and effort guidance for each.

- The portfolio team should work with the organization’s PMO or other governing groups to establish after action reviews at project close, and before action review of new ideas to apply lessons learned. This overall starts a continuous improvement thread in each active investment. This Portion of the Level 5 Portfolio will begin to blur the lines between the PMO and the Portfolio Group somewhat, which should be natural as continuous improvement focus increases.

Conclusion

Overall Portfolio Management is an important part of any organization to ensure proper selection of aligned initiatives to identify strategic value, foster executive alignment of idea selection, coordinate high level planning around resources, and to maximize return of active investments.

While portfolios can range in complexity and control it is important to always ensure that the level of control of the portfolio does not begin to exhibit diminishing returns by over sizing portfolio capability until it is required.

About the Author

Brent Weigel is a Manager with Kenny & Company. He leads and supports the defining, analysis, planning, implementation and overall execution of client engagements. In addition, Brent provides thought leadership and leads the development of the Cloud Computing Strategy & Consulting Services offering for Kenny & Company. Brent has more than 13 years experience in IT Consulting, software, startups and manufacturing with Booz Allen Hamilton, Standard Register and Stage Logic. He has a BS in Electrical Engineering with Computer Science Minor and a MS in Engineering Management from Rose-Hulman Institute of Technology along with a variety of certifications in areas such as Six Sigma, ITIL v3, and Microsoft technologies.

About Kenny & Company

Kenny & Company is a management consulting firm offering Strategy, Operations and Technology services to our clients.

We exist because we love to do the work. After management consulting for 20+ years at some of the largest consulting companies globally, our partners realized that when it comes to consulting, bigger doesn’t always mean better. Instead, we’ve created a place where our ideas and opinions are grounded in experience, analysis and facts, leading to real problem solving and real solutions – a truly collaborative experience with our clients making their business our business.

We focus on getting the work done and prefer to let our work speak for itself. When we do speak, we don’t talk about ourselves, but rather about what we do for our clients. We’re proud of the strong character our entire team brings, the high intensity in which we thrive, and above all, doing great work.

Notes

- See “Setting the Foundation for Strategic Portfolio Planning” on Kenny & Company Points of View for details of an Idea Package.

- See https://en.wikipedia.org/wiki/A3_Problem_Solving for example template and explanation of A3 Problem Solving.

- Typically scoring is done on a 0-3 scale where: 0=no value, 1=minimal value, 2=moderate value, and 3=high value.

- See http://asq.org/learn-about-quality/decision-making-tools/overview/decision-matrix.html

- See page 1 of http://www.unt.edu/rss/class/Jon/Benchmarks/CompositeScores_JDS_Feb2012.pdf

- See section on Capital Asset Pricing Model http://ardent.mit.edu/real_options/RO_current_lectures/CAPM%2005.pdf

This article was first published at michaelskenny.com on September 11, 2015. The views and opinions expressed in this article are provided by Kenny & Company to provide general business information on a particular topic and do not constitute professional advice with respect to your business.

Establishing Optimized Portfolio Management by Brent Weigel, Kenny & Company is licensed under a Creative Commons Attribution-NoDerivs 3.0 United States License .