Banner Section

Managing Quality in the Fuzzy Front End

Points of View - Inner

Managing Quality in the Fuzzy Front End

As the world continues to innovate and as companies increasingly bring new technological wonders to market, the list of product blunders and flops also continues to grow. In the last year (2011), the list of tech flops included Google’s Chromebook, Blackberry’s Playbook, Palm’s Veer, the Jawbone Up and HP’s TouchPad. In April 2010 HP announced the acquisition of Palm and its WebOS platform for $1.2B making a strategic investment to accelerate their tablet PC product development and time to market.

With this acquisition, HP became the latest entrant into the increasingly profitable and already crowded, $35B market dominated by Apple, Google and Microsoft.[1] HP’s TouchPad based on the Palm WebOS and disparagingly coined the “OuchPad”, was launched in July 2011.[2] When the TouchPad failed to meet sales forecasts, HP reacted quickly lowering its price, in the belief that a more competitive price point would increase consumer adoption. While this action did increase sales, the TouchPad was poorly received and was ultimately withdrawn from the market in August 2011. The reasons for many such product failures can be attributed to several causes including: product feature set, competitor market and distribution dominance, and/or competitive pricing. We believe that these causes may be identified earlier with a more structured analysis and quality focus in the pre-development phases of the Product Development Lifecycle (PDLC). These pre-development phases are often referred to as the “Fuzzy Front End” (FFE) due to the unstructured nature of the activities that occur during these initial phases of the PDLC.

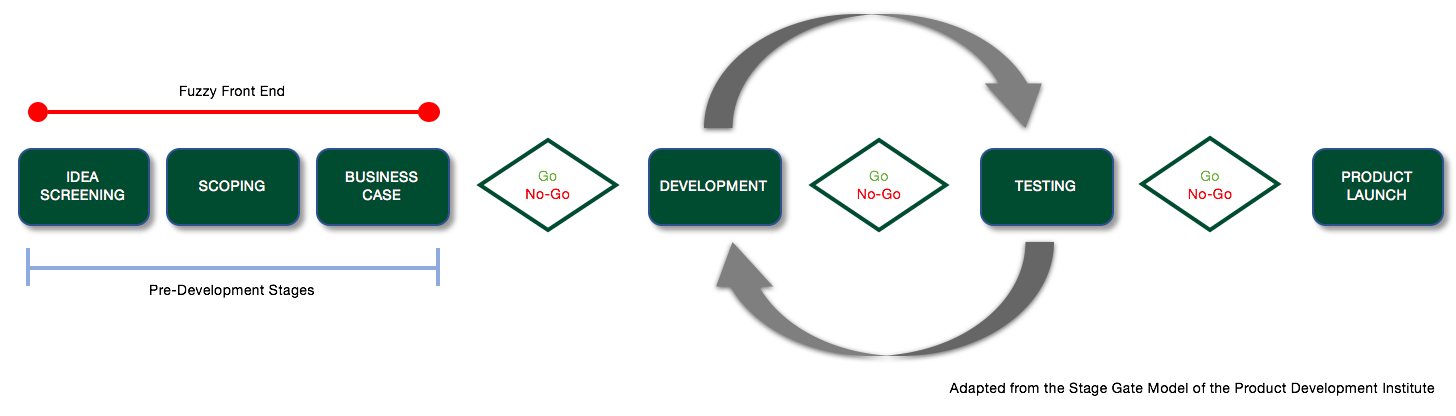

“Only one product concept out of seven becomes a new product winner and 44 percent of businesses’ product development projects fail to achieve their profit targets.”[3] As organizations increase the velocity of new product development, the ability to evaluate ideas in the FFE (Figure 1) of product development becomes increasingly important.[4]

The challenge for many of these organizations is to create the optimal combination of people, processes, technology, tools and measures, to facilitate a more structured analysis of the FFE and also build a Quality Measurement Framework (QMF) for the FFE to measure and improve the organizations PDLC.

Figure 1: The PDLC and The Fuzzy Front End

The FFE of the PDLC consists of: Idea Screening, Scoping and Business Case.[5] Many product failures occur due to “inadequate assessment of market climate, a questionable pricing strategy, [and] a poor selection of attributes or benefits – all areas to be addressed in the Fuzzy Front End.[6]

Five key questions executives should ask when reviewing their New Product Development (NPD) organization and processes are:

- How much emphasis is placed on the pre-development phases of the framework?

- How is the quality of progress in each stage of the Fuzzy Front End tracked and measured?

- Is there a framework in place that allows the organization to be future looking in the market for this product type?

- How does the organization benchmark NPD processes and measure for continuous improvements?

- Is there a dedicated individual or team to manage and tweak the NPD framework based on continuous improvement measures?

Execute with Quality

An organization’s NPD process should emphasize quality by improving the NPD stage activities, measuring both quantitatively and qualitatively and by seeking continuous improvement throughout the entire NPD lifecycle, including the initial FFE phases. Definitions and perceptions of quality may vary. The traditional definitions of quality have generated established methods and automated tools available for organizations to measure quality and progress in the development and post-development stages of the NPD process. However, these definitions of quality translate poorly when measuring the quality of a product in the pre-development FFE.

A study by Cooper and Kleinschmidt of the IEEE concluded that, “the greatest differences between winners and losers are found in the quality of execution of pre-development activities [and] a well-defined product and project prior to the development phase”.[7] Yet, Cooper and Kleinschmidt also found that “pre-development activities received the least amount of attention… compared to the product development and commercialization stages”.[8]

The non-traditional measures of quality in the early phases of the PDLC include Ideation Analysis, Desirability of Product and Features, Profitability, Risk Assessment and Alignment to Strategic Goals. Other ways to establish quality in early phases include strategies such as Benefit Structure Analysis, Test Marketing or Speed-to-Market. These strategies can bring clarity and structure to the “fuzziness” by providing an opportunity for executives to make well-informed decisions, when taking all elements of quality into consideration. By enabling the organization with a QFE, one can increase the organization’s ability to filter flawed product strategies earlier in product development and avoid an expensive “ouch” moment.

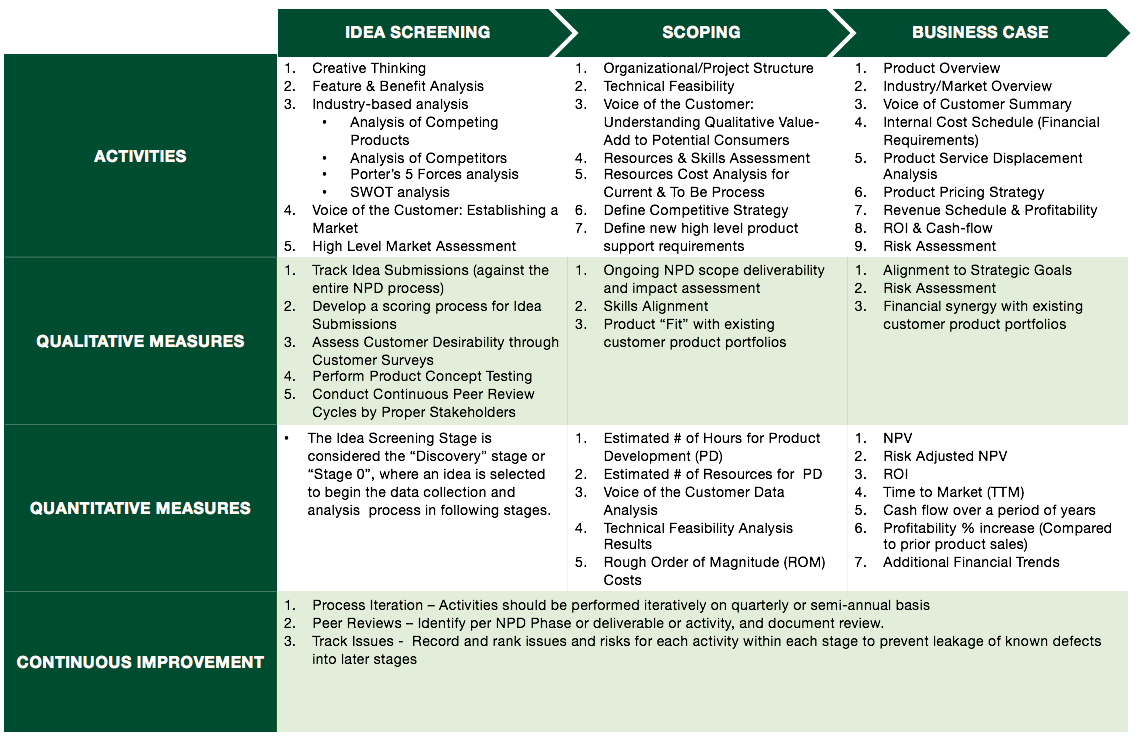

Figure 2: The Fuzzy Front End Framework

Through our consulting practice, we have developed a framework for assessing quality in the Fuzzy Front End (Figure 2). This framework consists of activities, qualitative measures, quantitative measures and opportunities for continuous improvements. This framework is relevant to all industries and organizations and can generate key measures for a product’s success.

Idea Screening

Idea Screening is the initial stage of the NPD process, where ideas are formed and analyzed to determine if there is a potential market for the product. Whether it is enhanced features to an existing product spurred by consumer reviews or a new innovative product, all ideas in the idea screening phase should follow the organizations standard NPD activities with an emphasis on qualitative and quantitative measures to ensure quality in the FFE.

Activities

- Creative Thinking: Promote creative thinking as a means to produce potential products, product features and markets. Prevent the regeneration of “old” ideas or variations of existing products by implementing measures to track and record all ideas. Document the outcomes of the idea progression as you progress through the Idea Screening phase.

- Features and Benefits Analysis: Identify the product features with high level descriptions, then determine the benefit or value proposition to the consumer.

- Industry Based Analysis: Perform an industry analysis to understand critical components that drive sales and profitability such as market size and trends, competitors, direct or indirect competing products, sales trends and growth factors.

- Voice of the Customer: Identify existing or potential customers and seek their feedback to how the features and benefits meet their needs. Work with true decision-makers and other stakeholders directly related to the product and cover benefits from a variety of perspectives.

- Market Studies: Perform a high-level market assessment to test the product concept and determine product viability and customer propensity to buy.

Qualitative Measures

- Idea Submissions: Track and document idea submissions throughout the entire NPD process.

- Scoring Process: Develop a scoring process with metrics to determine idea’s level of quality.

- Voice of the Customer: Assess consumer desirability by scoring how the features and benefits resonate with and meet their needs.

- Product Viability: Perform Product Concept Testing score and rank the product viability and customer propensity to buy.

- Review Cycles: Conduct Continuous Peer Review Cycles with stakeholders.

Quantitative Measures

- The Idea Screening stage is often considered the “Discovery” stage or “Stage 0”, where an idea is selected to begin the data collection and analysis process in following stages. This stage is the most creative stage of the process and does not readily lend itself to quantitative analysis apart from identifying the number of ideas generated, the number of ideas that resulted into successful products and historical success.

Scoping

The Scoping or Technical Evaluation stage is the second stage in which the core product is analyzed to determine whether it can be built to technical, functional and performance specifications; product marketing is also explored in this stage.

Activities

- Organization Structure: Form a team structure around the product that will drive the Scoping phase activities. Consider this as the product’s core team that will be charged with periodically evaluating the results from Scoping activities.

- Technical Feasibility: Perform a metrics-based technical feasibility assessment to verify and score the extent to which a product can be delivered (reviewing features, requirements, technology, materials, and labor), and performs (functionality) as expected. The feasibility assessment should include both tactical and operational planning of the product.

- Voice of the Customer: Identify the qualitative value-add to potential consumers to determine the extent to which the product meets their needs and their propensity to buy.

- Resources and Skills Assessment: Identify the necessary resource experience and skill set required to deliver product.

- Resource Cost Analysis: Identify expected resource, time and labor demands for new product delivery including any impact the new product would have on existing processes.

- Competitive Strategy: Define the competitive strategy and positioning as you begin to understand the feasibility of the product and associated costs, in addition to the market research completed.

- Support Requirements: Define new high level product support requirements.

Qualitative Measures

- Assessment: Ongoing NPD scope deliverability and impact assessment.

- Skills Alignment: Assess existing resource skills and ability to deliver a new product and identify gaps in resource skills to be developed or acquired.

- Product Alignment: Assess the product “fit” with existing customer product portfolios.

Quantitative Measures

- Estimated Hours for Product Development

- Estimated Resources for Product Development

- Voice of the Customer Data Analysis

- Technical Feasibility Analysis Results

- Rough Order of Magnitude (ROM) Cost

Business Case

Business Case and Strategic Planning is the final pre-development phase of the NPD process. This phase is a summarized analysis of product and marketing research, financial analysis, revenue profitability and risk assessment. This phase not only validates the activities performed in the Idea Screening and Scoping stages, but also provides the stakeholders with a quantitative analysis to make a go or no-go decision to move forward with the Development phase.

The activities in this phase build upon one another to create a complete business case. It is critical that any data used for quantitative or qualitative analysis is accurate as possible. This data will drive the development of the product cost model and business case.

It is also essential to perform a thorough due diligence. Study your competitors’ strengths and weaknesses and compare products from direct and indirect competitors.

Finally, review and test your business model with multiple outcomes. Ensure all revenue streams and costs are included in the business model, including product cost justifications and assumptions.

Activities

- Product Overview: Develop a high-level product overview incorporating the features, benefits and value proposition.

- Industry/Market Overview: Define the target industry or industries and market(s) that the product will serve.

- Voice of Customer Summary: Aggregate analysis from the Voice of the Customer activities.

- Internal Cost Schedule (Financial Requirements): Identify all internal costs, both fixed and variable to deliver and provide ongoing support for product.

- Product Service Displacement Analysis: Identify customer costs in terms of resource time and effort and asset replacement which the new product will be displacing.

- Product Pricing Strategy: Develop the product pricing model and strategy.

- Revenue Schedule & Profitability: Create five to ten year revenue model based on sales scenarios to determine profitability.

- ROI & Cash-flow: Leverage revenue schedule to determine break even analysis, ROI and year over year cash flow based on sales scenarios and projections.

- Risk Assessment: Identify areas of risk based on all preceding activities with mitigation activities based on multiple scenarios.

Qualitative Measures

- Alignment to Strategic Goals: Assess how new product aligns to broader product roadmap vision and goals.

- Risk Assessment: Analyze all areas of risk with mitigation plans to determine optimal paths that reduce risk potential.

- Financial Alignment: Determine level of financial synergy with existing customer product portfolios.

Quantitative Measures

- Net Present Value (NPV)

- Risk Adjusted NPV

- ROI

- Time to Market (TTM)

- Cash flow over a period of relevant # of years

- Profitability % Increase

(compared to prior product sales) - Additional Financial Trends

Continuous Improvement

For each phase, it is important to focus on refining and improving the activities, qualitative and quantitative measures.

- Process Iteration: Activities should be performed iteratively on a quarterly or semi-annual basis.

- Peer Reviews: Identify per NPD Phase or deliverable or activity and document reviews.

- Track Issues: Record and rank issues and risks for each activity within each stage to prevent leakage of known defects into later stages.

Conclusion

Organizations should implement a Quality Measurement Framework (QMF) for the Fuzzy Front End to improve the processes and activities within the organization’s existing product development process. The following recommendations can guide you in your management of quality and bring greater visibility to the FFE.

- Establish a Measurable NPD Framework – Define a NPD stage gate model customized for your organization.

- Identify the processes and activities, and the right stakeholders for each stage gate to ensure accurate validation of these processes and activities.

- Implement “SMART(ER)” (Specific, Measurable, Achievable, Realistic, Timely, Effective, Results Orientated) metrics.[9]

- While accurate figures may be difficult to generate during the initial stages of the Product Development process, involve the proper stakeholders, skilled resources, effective tools and metrics so you can provide a clearer path to product development by having a controlled outcome of the product in a given market.

- Benchmark and continuously improve the NPD process. This is especially important for new or young organizations, by adopting continuous improvement earlier on in the NPD process the organization, can avoid making poor product innovation decisions and strengthen the NPD process from product inception to market launch.

About the Author

Saima Siddiqui is a Management Consultant with Kenny & Company and has over 6 years consulting experience with Accenture. She has led NPD and QA projects and implemented Test Strategies, Metrics Reporting and QA Processes across industries for custom-designed and out-of-the-box systems.

About Kenny & Company

Kenny & Company is a management consulting firm offering Strategy, Operations and Technology services to our clients.

We exist because we love to do the work. After management consulting for 20+ years at some of the largest consulting companies globally, our partners realized that when it comes to consulting, bigger doesn’t always mean better. Instead, we’ve created a place where our ideas and opinions are grounded in experience, analysis and facts, leading to real problem solving and real solutions – a truly collaborative experience with our clients making their business our business.

We focus on getting the work done and prefer to let our work speak for itself. When we do speak, we don’t talk about ourselves, but rather about what we do for our clients. We’re proud of the strong character our entire team brings, the high intensity in which we thrive, and above all, doing great work.

Notes

-

- J. P. Morgan Investment Note February 2011

- Magee, David, August 17, 2011, International Business Times, OuchPad: HP’s Big TouchPad Problem: It Isn’t an Apple iPad

- Cooper, Robert G., Professor Marketing, McMaster University, Canada and President of Product Development Institute Inc., Winning at New Products: Pathways to Profitable Innovation

- Smith, P. G., Reinertsen, D. G., 1991, Developing products in half the time, New York: Van Nostrand Reinhold

- Product Development Institute, Inc., 1996, Stage Gate – Your Roadmap for New Product Development

- Copernicus Marketing Consulting and Research, January 2010, Top Ten Reasons for New Product Failure

- R. C. Cooper, E. J. Kleinschmidt: Screening New Products for Potential Winners; Institute of Electrical and Electronics Engineers IEEE engineering management review 22 (1994) 4: 24-30

- R. C. Cooper: Predevelopment Activities Determine New Product Success; Industrial Marketing Management 17 (1988) 2: 237-248

- The first known use of the mnemonic SMART for objectives was by George T. Doran. Doran, G. T. (1981). There’s a S.M.A.R.T. way to write management’s goals and objectives. Management Review, Volume 70, Issue 11(AMA FORUM), pp. 35-36.

This article was first published on www.michaelskenny.com on January 13, 2012. The views and opinions expressed in this article are provided by Kenny & Company to provide general business information on a particular topic and do not constitute professional advice with respect to your business.

Managing Quality in the Fuzzy Front End by Saima Siddiqui, Kenny & Company is licensed under a Creative Commons Attribution-NoDerivs 3.0 United States License.