Banner Section

The Business of Healthcare Delivery

Points of View - Inner

In the United States, healthcare is delivered within a variety of business models, such as not-for-profit, private, public-private collaborations and public sector. In an industry with perpetually rising costs, unpredictable payment reform, reduced government subsidies and massive regulatory changes, healthcare delivery organizations must invest in core business competencies to remain viable.

The healthcare industry’s “…rate of change is profound, and it’s only going to get significantly faster”.[1] Payment (or reimbursement) reform is driving many changes; increased risk arrangements in physician and hospital contracts, value-based purchasing, higher volume of patients with low-paying insurance (e.g., Medicaid), increasing high-deductible plans and government mandates with reduced-payment penalties. The operational, administrative and technical costs of delivering health services continue to increase; implementing and maintaining Electronic Health Records, increased reporting requirements (e.g., PQRS), coding changes (e.g. ICD-10) and expanding data and analytic needs (“big data”). Finally, in an increasingly competitive market where affiliations, consolidations, acquisitions and contracted partnerships are exploding, the imperative to evaluate and mature the core business competencies in healthcare delivery organizations is clear.

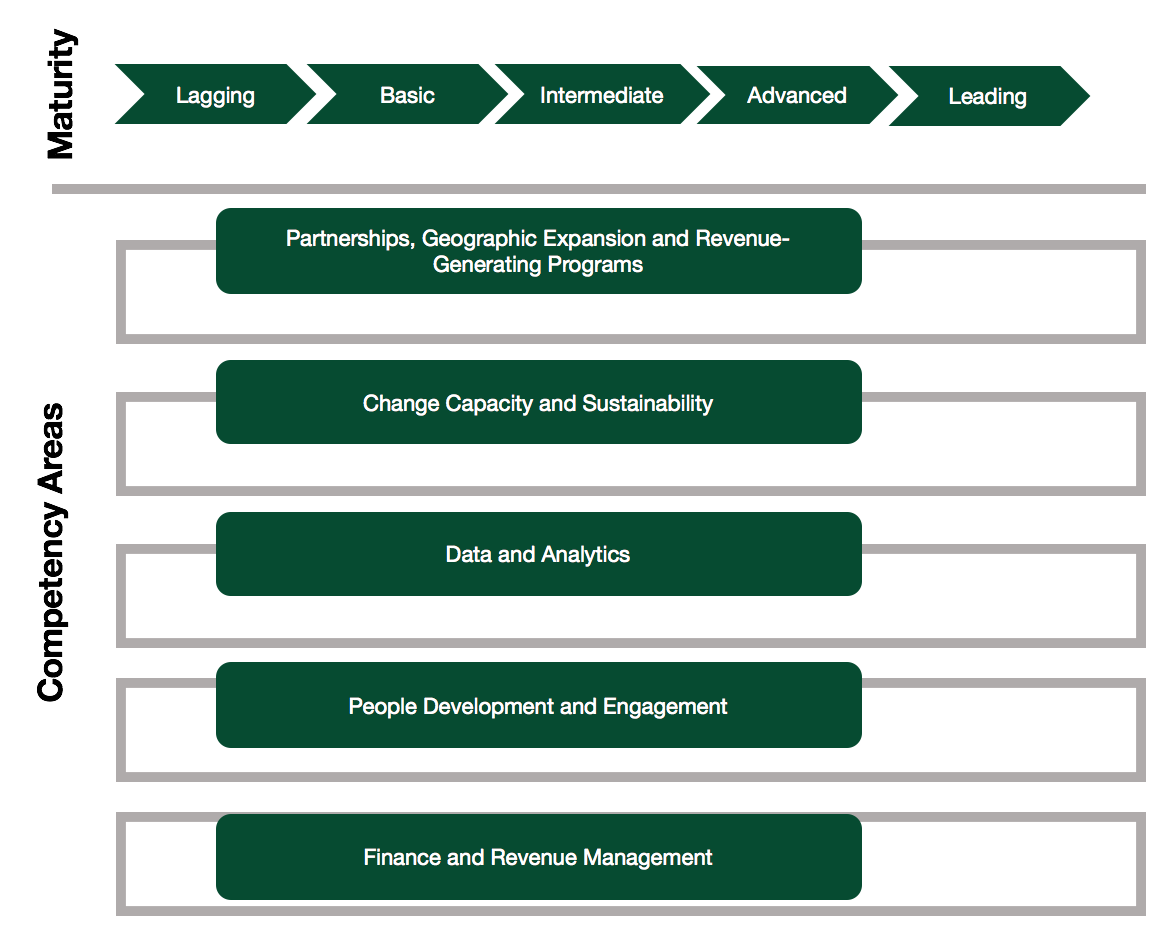

Aligning with the healthcare industry’s rapid transformation, Kenny & Company has developed a prescriptive Lagging to Leading Maturity Model for the business of healthcare delivery (Figure 1).

Figure 1: Leading to Lagging Maturity Model Components

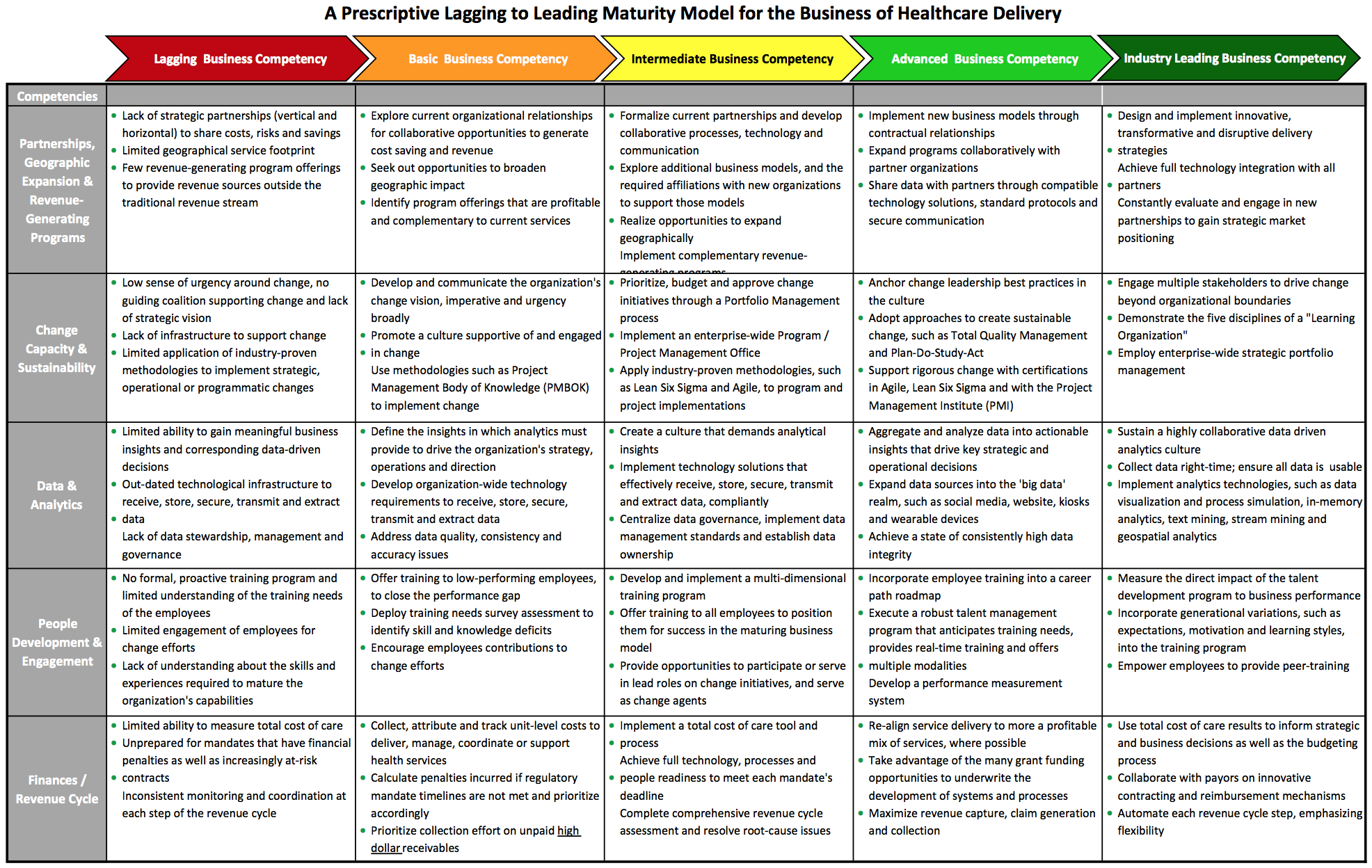

This paper focuses on the non-clinical operational, administration and technical components in healthcare delivery and does not include the clinical, pharmaceutical, life sciences or health insurance aspects of the industry. Our Lagging to Leading Maturity Model is a matrix of five evolving maturity and five discrete yet interdependent core competency areas. The Model (Table 1) empowers healthcare delivery organizations to assess their current business competencies and path towards maturity.

Table 1

The following sections define the five core competency areas, provide industry examples and offer links to best-in-practice industry methodologies and seminal thought leadership. The author then provides a prescriptive “how to” approach for organizations to evolve their business competency maturity in order to remain viable in the business of healthcare delivery.

Partnerships, Geographic Expansion and Revenue-Generating Programs

Healthcare delivery has entered a new world of creative multi-organizational models, such as Accountable Care Organizations and Patient-Centered Medical Homes. The models emphasize care coordination across the continuum, shared financial risk and economies of scale. Healthcare delivery organizations are expanding services through affordable, innovative programs, expansive partnerships and creative contracts that generate recurring revenue across a broader geography. Where does your delivery organization fit on the maturity model, and how is the next level of maturity achieved?

Maturing this core business competency begins by strategically evaluating opportunities with current partners that offer geographic expansion, such as satellite offices, subleasing with an existing practice, mobile delivery, and telehealth services. Successful partnerships collaboratively generate cost-savings as well as profit. Revenue opportunities outside the traditional revenue stream of capitation, fee for service payments, copays and deductibles are proactively sought after. New program offerings are identified based on profitability and are complementary to currently services. For example, develop a business plan to expand nutritional services, such as an enrollment-based bariatric program. Investigate the financial benefits of partnering with a local fitness center, selling nutritional products and supplements, offering one-on-one coaching and providing support groups that are located over a wide geography.

As organizational maturity grows, current partnerships are formalized with collaborative processes, technology and communication. New business models are explored, such as Accountable Care Organizations, mergers and acquisitions, and administrative consolidation. New affiliations support those models, such as risk/reward sharing, data exchange and vertical investment. Data sharing is advanced with trusted partners through compatible technology solutions, standard protocols and secure communication.

In the final stage of maturity, leading organizations design and implement innovative, transformative and disruptive delivery strategies for new business models, new services and new payment methods.[2] They have achieved full technology integration across the care continuum with all partners and are proactively evaluating and engaging in new partnerships to gain strategic market positioning.

A recent example of this competency is health plans and delivery systems investing in medical groups via the medical group’s Management Services Organization. In this case, the management company for Hill Physician Medical Group, PriMed Management Consulting Services, sold stakes to a group of investors comprised of two insurance companies and a large health delivery system including its affiliated medical group. Article: Hill Physician Founders Sell Stakes

Change Capacity and Sustainability

The ability to adapt, innovate and disrupt is the differentiator between leading healthcare delivery organizations and the rest. The healthcare industry is changing on an almost-daily basis. How do organizations not just keep up, but anticipate and stay ahead of the curve? Where is your organization’s change capacity competency level on the Lagging to Leading Maturity Model, and what does the next level of maturity reveal?

Maturing the change capacity competency begins with a sense of urgency around change, a guiding coalition to supporting change and a strategic vision.[3] Change agents are located at every level of the organization.[4] Methodologies such as the Project Management Body of Knowledge (PMBOK) guide change efforts. Growth continues with an enterprise-wide Program and Project Management Office (PPMO) that reports directly to the C-suite, and is guided by a central Portfolio Management process.

Why is a PPMO good for business? PPMOs deliver more successful implementations, realizing strategic, operational, technical and financial goals. Using standard templates and tools for repeatable implementations translates to less expensive implementations. Building program and project implementation capabilities empowers the organization to change efficiently and rigorously.

Organizations with a leading maturity level support rigorous change through certifications in Agile (Scrum Master, Scrum Product Owner, Scrum Developer), Lean Six Sigma (Yellow/Green/Black Belt) and with the Project Management Institute (Project/Program/Portfolio Management Professional). Outside stakeholders, such as consumers, payors, advocates, policy makers, employers, and ancillary providers, are engaged to drive change beyond organizational boundaries. The five disciplines of a “Learning Organization” are internalized, to stay ahead of health reform and remain a competitive force in the market.[5] Strategic portfolio management prioritizes and budgets high-impact work efforts and reduce the duration from ideation to implementation.[6]

Data and Analytics

The increasing availability of data in healthcare is driven largely by the growing number of healthcare delivery organizations implementing Electronic Health Record systems and using the data in meaningful ways. Driving the business of healthcare delivery requires analyzing volumes of data for useful insights and answering fundamental questions, as well as identifying patterns that lead to broader and more strategic questions. Where is your organization’s data and analytics competency level on the Leading to Lagging Maturity Model, and what does the next level of maturity reveal?

Developing the core competency of data analytics begins with a leadership-level understanding and appreciation for the meaningful business insights and corresponding value of data analytics.[7] The insights in which analytics must deliver to drive the organization’s strategy, operations and direction are clearly defined. A culture that demands data-driven, analytical insights permeates the organization. Data governance is centralized, data management standards are implemented and data ownership is supported by data stewards.

Preparing to negotiate a new or extend a current payor contract? Leverage an analytical tool such as a simulation model when analyzing the myriad of potential payment methodologies (bundled and episodic payments, risk-sharing agreements and value-based payments) to forecast financial outcomes and negotiate for better terms. A simulation model can also be used to estimate the impact of the ICD-10 transition.

Organizations with leading maturity levels expand data sources into the ‘big data’ realm, including social media, website, kiosks, wearable devices and other real-time sources.[8] A highly collaborative data driven analytics culture reveals surprising and strategic patterns. Technologies such as data visualization and process simulation, in-memory analytics, text mining, stream mining and geospatial analytics are broadly available.

People Development and Engagement

As a foundation for every business and a particularly valuable asset to healthcare delivery, great employees are hard to find and harder to retain. While employee training, development and engagement can be expensive, the cost of losing great employees is far more impactful to the bottom line. Changes required by the Affordable Care Act and other legislative mandates drive the need for formal training programs to ensure employee skills are relevant. Where is your organization’s employee training and engagement competency level on the Leading to Lagging Maturity Model, and what does the next level of maturity reveal?

Is meaningful employee engagement linked directly to retention? Yes! The October 30, 2013 Harvard Business Review article Employee Engagement Drives Health Care Quality and Financial Returns, quotes the 2012 Towers Watson global workforce study: “The study also shows a strong relationship between employees’ level of engagement and their likelihood to remain with their employer, with just 17% of the highly engaged hospital workers interested in other employment options versus 43% of the disengaged group.”

Developing and growing this competency is essential to the business of healthcare delivery. Maturing begins by identifying the skills and experiences required to support the organization’s evolving capabilities. A training-needs survey or a similar instrument is deployed to identify technical, communication, leadership, healthcare knowledge, relationship, professionalism and team skill deficits[9]. A training and development program covers many domains, including government mandates (e.g., ICD-10).

Leading organizations in people development and engagement execute a robust talent management program that anticipates training needs, provides real-time training and offers multiple modalities. The program is measured against pre-defined success criteria and regularly refined. Generational variations such as expectations, motivation and learning styles are incorporated into the training program. Employees are empowered and rewarded for providing peer-training to reinforce teamwork and the culture of a learning organization.

Finance and Revenue Management

The United States’ healthcare industry continues to suffer from the contradiction of delivering free or affordable care to those who need it, regardless of ability to pay, and the fact that healthcare is a business that must cover its cost of services in order to remain viable. This paper is focused on the business side of the contradiction, which underwrites the ‘care for all’ side. Effective management of the full revenue lifecycle, identifying other revenue sources, and the ability to calculate and make decisions based on total cost of care describes the final competency for evaluation. Where is your organization’s competency level on the Leading to Lagging Maturity Model, and what does the next level of maturity reveal?

An obvious yet underemphasized core competency, finance and revenue management provides the foundation for all other competencies in the business of healthcare delivery. Early in the maturity model, preparations for mandates with financial penalties (International Classification of Diseases-ICD-10, Meaningful Use, Physician Quality Reporting System-PQRS, Health Information Portability and Accountability Act-HIPAA) as well as increasingly risk-sharing contracts (Accountable Care Organizations-ACOs, Patient-Centered Medical Home-PCMH) are underway. The revenue cycle is monitored and coordinated at each step, uncovering common issues such as incomplete encounters, charges not being entered, incorrect coding, billing delays, lack of appeals and high bad debt. Unit-level costs incurred in the delivery, management, coordination and support of health services are collected, attributed and monitored.[10]

A Medical Economics’ article entitled Top 10 Challenges Facing Physicians in 2014 identified that obtaining payment for medical services is the #1 challenge physicians faced in 2014. A central theme is the Affordable Care Act’s government reimbursement changes (and penalties), such as bundled payments, Patient-Centered Medical Homes, hospital re-admission, hospital-acquired infections, value-based purchasing and shared savings.

Leading organizations implement a total cost of care tool and process, then identify overuse and inefficiency, evaluate cost-saving opportunities and negotiate higher payor reimbursement rates.[11] Service delivery is re-aligned to a more profitable mix of services, where possible. Grant funding opportunities are pursued to underwrite the development of systems and processes, in anticipation of additional mandates, regulations, compliance requirements and overall health reform. Each revenue cycle step is automated, including transactions between payors, providers and ancillary service providers, with an emphasis on flexibility to apply new reimbursement models.

Evolving Business Competency Maturity

Shifting healthcare delivery organizations into a more mature business requires a structured, rigorous, repeatable and measured process, founded on leadership commitment to change. Kenny & Company recommends a five-phase, iterative effort to evolve business competencies on the Lagging to Leading Maturity Model.

- Discovery. Organizations cannot evolve without first understanding their current state. A broad and deep discovery process into the strengths and weakness of core business competencies, framed by the Lagging to Leading Maturity Model, provides the critical baseline in which change is strategically assessed.

- Strategic Assessment. Gaining critical insight into the current state enables organizations to identify their position on the Leading to Lagging Maturity Model. Then, the future state blueprint is based on achieving the next level of competency maturity.

- Gap Analysis & Prioritize. The current state baseline and future state blueprint are used as inputs to identify and analyze the gaps between the two states. Comprehensive evaluation of the necessary human capital, investment and impact to close each gap results in prioritized change efforts that reflect organizational constraints.

- Roadmap & Implement. A time-based, integrated roadmap of the planned changes is an essential tool to communicate and achieve buy-in across the organization. The roadmap is also used to build coordinated work plans, aligning shared resources and tools that enable collaborative implementations.

- Measure & Refine. Pre-defined success criteria measure success at the conclusion of each change effort. Performance metrics measure the ongoing success of change and support data-driven decisions on re-assessing strategy. Refinement of the Lagging to Leading Maturity Model is driven by healthcare industry developments, including new regulations, market changes, politics and innovations.

The five-phase approach is an iterative process, supporting organizations as they continuously achieve more mature stages in their core business competencies.

Conclusion

The rapid pace of healthcare change is significantly impacting the bottom line of healthcare delivery organizations. The imperative to change is now. Using our prescriptive Lagging to Leading Maturity Model, Kenny & Company urges healthcare delivery organizations to measure and evolve their critical business competency maturity to remain a vital and viable provider of healthcare services. Evolving the maturity level of core business competencies requires a five-phase iterative process; understand current state, strategically assess future state, identify and analyze gaps, develop a roadmap to propagate change and coordinate implementations, and measure success and refine strategic direction. Sustainable organizations in the rapidly changing healthcare industry are thoroughly examining their core business competencies and strategically committing to increasing their level of maturity.

About the Author

Shani S. Trudgian is a Partner at Kenny & Company and has over 20 years consulting experience with Accenture, Deloitte and Freed Associates. As a thought leader and industry advisor, Shani has guided her clients through health reform readiness strategy, ICD-10 readiness approach, ambulatory heath care delivery refinement, business model analysis, organizational development, change leadership and in other strategic areas.

Shani’s industry experience includes medical groups/IPA, hospitals, health plan (public/private), safety net clinics, department of public health, dental insurance, oral health delivery, non-profit grant-making philanthropy, and behavioral health organizations.

About Kenny & Company

Kenny & Company is a management consulting firm offering Strategy, Operations and Technology services to our clients.

We exist because we love to do the work. After management consulting for 20+ years at some of the largest consulting companies globally, our partners realized that when it comes to consulting, bigger doesn’t always mean better. Instead, we’ve created a place where our ideas and opinions are grounded in experience, analysis and facts, leading to real problem solving and real solutions – a truly collaborative experience with our clients making their business our business.

We focus on getting the work done and prefer to let our work speak for itself. When we do speak, we don’t talk about ourselves, but rather about what we do for our clients. We’re proud of the strong character our entire team brings, the high intensity in which we thrive, and above all, doing great work.

Notes

- Diane Holder, President and CEO, University of Pittsburg Medical Center Health Plan, Holder: Health care’s ‘rate of change is profound’

- Refer to the Harvard Business Review article How to Make Health Care Accountable When We Don’t Know What Works for leading examples of delivery system strategies and models.

- Refer to John Kotter’s seminal methodology “Leading Change”.

- Refer to Dagmar Recklies’ What Makes a Good Change Agent? article; the section outlining the 15 competencies of change agents can help guide the selection of powerful change agents.

- The Fifth Discipline, by Peter Senge, describes how advanced organizations handle rapid change through the flexible, adaptive and productive traits of a learning organization; refer to a summary of the Fifth Discipline.

- Refer to Kenny & Company’s Setting the Foundation for Strategic Portfolio Management whitepaper for the five stages of idea brainstorming, a requirement for successful strategic portfolio management.

- The Winter 2011 article from MIT Sloan Management Review, Big Data, Analytics and the Path from Insights to Value, cites “The leading obstacle to widespread analytics adoption is lack of understanding of how to use analytics to improve the business …” Read the full article for a pragmatic approach to enterprise-wide analytic implementation and adoption.

- Ready to tackle Big Data? Read McKinsey&Company’s The Big-Data Revolution in US Health Care: Accelerating Value and Innovation

- Refer to the Healthcare Leadership Alliance (HLA) Competency Directory for an extensive, healthcare-specific tool to survey employee competency levels across a broad spectrum of domains.

- Refer to AARF’s Calculating Your Costs Per Visit article for a six-step process to calculate and perform unit cost analysis.

- Healthcare Partners provides Technical Implementation Guidelines in the 6/16/2014 ” style=”color: rgb(68, 68, 68); text-decoration: none; outline: 0px;”>Total Cost of Care and Resource Use article.

This article was first published on www.michaelskenny.com on December 18, 2014. The views and opinions expressed in this article are provided by Kenny & Company to provide general business information on a particular topic and do not constitute professional advice with respect to your business.